Phil Zywot, Head of North American Equities and U.S. Corporates (Securities Finance) at BNY Mellon and Chair of the T+1 Subcommittee of CASLA, provides an update on Securities Lending and T+1 in collaboration with the Canadian Capital Markets Association (CCMA). Additionally, Phil sits on both the CCMA’s T+1 Steering Committee and Operations Working Group.

“Industry participants need to review ways of streamlining information flow of transactions to their custodial banks on trade date, allowing agent lenders to efficiently execute timely recall notifications to the borrowing community, which, in turn, would give them enough time to source replacement securities to fulfill T+1 settlements.”

Phil Zywot, Head of North American Equities and U.S. Corporates (Securities Finance) at BNY Mellon, chairs the Canadian Securities Lending Association (CASLA) T+1 Subcommittee and sits on both the Canadian Capital Markets Association (CCMA) T+1 Steering Committee and Operations Working Group. In November 2022, he explained to CCMA members that in a T+1 environment, securities lending participants no longer have today’s one-day cushion and will have to know by the end of trade date (T):

- what securities they will need to settle

- what securities are available

- what is out on loan and has to be recalled

- where to go for any securities not on hand or available for recall.

He said the securities lending industry must focus more urgently on T+1 because it will have a greater impact on the industry than the move to T+2.

Fast forward six months. The topic of T+1 is being discussed more frequently by the CASLA board – one of the top topics, in fact. Phil says CASLA members are showing good engagement, adding: “For securities lending market participants, the T+1 project has gone from 0 to 100 km, from being a blip on the horizon to

having two to three meetings a week.”

CASLA members are engaging with three groups:

- Third-party solution providers to standardize, automate, and track the recall

process from agent lender to borrower - The TMX Group to explore a way to pair agent lenders that are long inventory

in CDS with participants requiring securities to help fulfill sales - SIFMA to keep the two countries’ securities lending markets aligned and see

whether anything new can be learned from U.S. efforts.

Next steps are agreeing on an industry standard(s) (targeted for summer 2023) and moving ahead with enhanced automation of the recall process. An automated solution is not likely to materially change current systems, but instead will automate and standardize the recall process within the existing infrastructure

of the lending community.

Background

What’s the possible impact of moving to T+1 on securities lending and settlements?

Without changing current processes, the number of fails will increase, with direct and indirect costs:

- Agent lenders receiving late trade notifications from beneficial owners would result in recalls being issued late, but still due on settlement date.

- Borrowers would have less time to return securities and have a day less to find an alternative supply source.

What does this mean?

- It will be more difficult because there will be less time to source hard-to-borrow/less-liquid ‘names’ (securities) in the market.

- Agent lenders may need to hold back larger amounts of securities (buffers) to help cover sales, reducing market liquidity.

- The number of buy-ins (repurchases) of a security for a failing recall (the original seller fails to deliver the shares as promised) – currently extremely rare in Canadian markets – will almost certainly increase.

- Corporate action events related to loaned securities, depending on their type and timing, may also be impacted due to a lessened timeframe for stakeholders to react accordingly.

What needs to be done:

- All parties in the securities lending ecosystem must be educated about the T+1 impacts on securities lending.

- Beneficial owners must look at automated solutions to notify their custodians and agent lenders in a more timely fashion – ideally real-time notice, or at least more frequent batches – so that their agent lenders can process the transaction and recall (if required) on trade date.

- Agent lenders must look at technology upgrades and other enhanced straight-through processing (STP) solutions for recalls to gain efficiencies.

- Borrowers must place more urgency on repaying recalls and will have a day less to source an alternative source of supply.

- Custody agreements / terms & conditions and securities lending agreements may need to be altered.

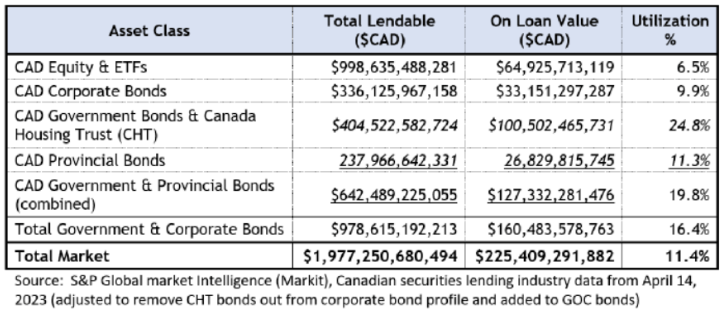

Canadian securities lending market by the numbers:

- There are approximately C$1 trillion in lendable Canadian equities across the total lendable market, with about C$65 billion out on loan at any given time – a 6-8% utilization rate (as shown in this table; there also is an almost similar amount of government and corporate debt, with a 16% utilization rate).

- Of the C$65 billion in loaned equities, ‘warms’ (securities in quite high demand relative to market availability and so more expensive to borrow) and ‘specials’ (‘hot’ or harder-to-borrow securities that can command returns of over 100 bps compared to a general average of 24 bps annually) total about C$6 billion (10% of assets on loan and less than 1% of total lendable assets), with ‘specials’ totaling about C$2 billion (3%) of outstanding loans.

- Over 90% of equity sales a beneficial owner executes do not impact a securities lending program as these positions are not out on loan but rather sitting in the client’s custodial account.

- Even if a security is out on loan, another lending client’s position can often be reallocated/substituted for that of the original client.

- When a position cannot be reallocated or substituted by another lending client’s position, the loaned securities must be recalled, however, this currently accounts for less than 5% of client sales.

- Less than 1% of fails of the total amount of sales executed by clients are attributable to a security being out on loan… at least in a T+2 world.

- This number of fails can still be material for certain ‘names’ – less liquid securities (various specials’) that are heavily in demand are more likely to result in the recall and sale failing and this may be more challenging when the settlement standard is T+1.

Securities lending is

sometimes called the

grease keeping the cogs of

the financial system

turning. It provides liquidity

for trading and settlement,

reduces volatility, and helps

in price discovery on

exchanges and bilateral

markets. It provides

incremental income for

securities lenders (e.g.,

pension funds and

retirement plans) so net

beneficiary returns

improve.

Through these roles,

securities lending facilitates

capital formation, transfers risk, and supports long-

term wealth accumulation. Pension plan and global

investment fund complex

annual reports show

securities lending

contributes uncorrelated,

consistent investor returns,

including during difficult

market conditions.